EXPERIENCED. TRUSTED. SECURE.

Commercial Mortgage Loans to Empower Your Financial Success

Accurate & Reliable Quotes

No-Obligation Consultations

Professional & Secure Services

Accurate & Reliable Quotes

No-Obligation Consultations

Professional & Secure Services

Introducing the ABMC Advantage

The mission at ABMC Capital Group, LLC, is to provide Florida clients with the best loan options on commercial properties while alleviating the typically drawn-out loan process and providing you with outstanding customer service. Our team is your best source for commercial loans in the industry, and we won’t rest until we've exceeded your expectations. If you have questions, want to request a quote, or are ready to get started, feel free to call or send us a message any time. We look forward to serving you!

COMPREHENSIVE. ACCURATE. FAST.

ABCM Streamlines the Loan Application Process

1. Select Your Service

Choose a specific loan or property type from our comprehensive list.

2. Fill Out the Form

Provide essential details using our quick 30-second form, without an SSN or credit check!

3. Receive Your Quote

Get an accurate and reliable quote instantly, based on the information you provided.

4. Request a Consultation (Optional)

Request a no-obligation consultation with our experts to discuss your quote and financing options in detail.

OUR MORTGAGE Loan Wizard:

We’ve Built a Safe and Personalized Experience

This

FREE, quick, and easy interactive

Commercial Loan Wizard has been designed to assist you based on your individual needs. The more questions you answer, the more accurate your results are. You’ll receive the loan information you need instantly, without any hassle!

Quick, 30-second form.

No social security number needed.

No credit check required.

Hassle-free, no-obligation process.

We Provide Loans for the Following Property Types:

Explore the list of property types covered by our commercial mortgage loan services below to see if we can help fund your next real estate project. If you have any questions or concerns, please contact

a

private

lender.

Residential and Accommodation Properties

- Agricultural Use

- Apartment (5-20 Units)

- Apartment (21+ Units)

- Bed & Breakfast

- Condo Conversion

- Hotel Condo

- Investment Condo

- Mobile Home Park

- Multi Family (2-4 Units)

- Multi Family (5+ Units)

- Rooming House

-

Residential, Leisure, and Investment

Agricultural Use

Apartment (5-20 Units)

Apartment (21+ Units)

Bed & Breakfast

Condo Conversion

Hotel Condo

Investment Condo

Mobile Home Park

Multi Family (2-4 Units)

Multi Family (5+ Units)

Rooming House

Commercial Retail and Services

- Auto Services

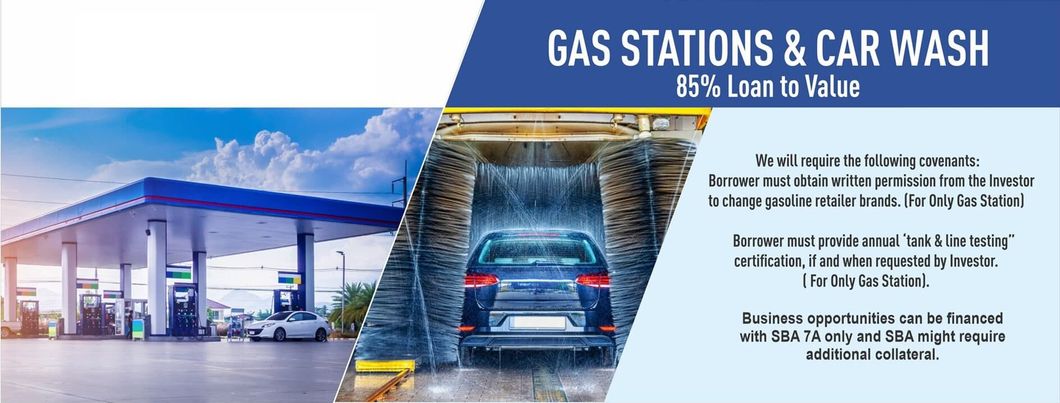

- Carwash

- Convenience Store with Gas

- Dry Cleaner

- Funeral Home

- Gas Station

- Laundromat

- Marina (Lake Access)

- Marina (Ocean Access)

- Marina with Gas (Lake Access)

- Marina with Gas (Ocean Access)

- Restaurant

- Retail

- Self Storage

-

Commercial, Retail, and Services

Auto Services

Carwash

Convenience Store with Gas

Dry Cleaner

Funeral Home

Gas Station

Laundromat

Marina (Lake Access)

Marina (Ocean Access)

Marina with Gas (Lake Access)

Marina with Gas (Ocean Access)

Restaurant

Retail

Self Storage

Institutional and Industrial Properties

- Campground / RV Park

- Church

- Day Care Center

- Educational Center

- Health Care / Assisted Living

- Hospital

- Hotel / Motel

- Light Industrial

- Office

- Office Condo

- Parking Garage

- Warehouse

- Warehouse Condo

-

Institutional, Recreational, and Industrial

Campground / RV Park

Church

Day Care Center

Educational Center

Health Care / Assisted Living

Hospital

Hotel / Motel

Light Industrial

Office

Office Condo

Parking Garage

Warehouse

Warehouse Condo

Development, Financial, and Miscellaneous

- Development (Commercial)

- Development (Residential)

- Equipment Financing

- Golf Course

- Mixed Use

- Working Capital

-

Development, Financial, and Miscellaneous

Development (Commercial)

Development (Residential)

Equipment Financing

Golf Course

Mixed Use

Working Capital

Explore Our Commercial Loan Options

Bridge loans are short-term (usually one to three months) loans advanced to cover the period between the termination of one loan and the start of another. It is generally arranged to complete a purchase before the borrower receives payment from a sale or before a long-term loan is made available upon fulfillment of its requirements (such as commissioning of a facility or a plant). Also called bridge finance, bridging loan, or gap financing.

A commercial mortgage is a loan made using real estate as collateral to secure repayment.

A commercial mortgage is similar to a residential mortgage, except the collateral is a commercial building or other business real estate, not residential property.

In addition, commercial mortgages are typically taken on by businesses instead of individual borrowers. The borrower may be a partnership, incorporated business, or limited company, so the assessment of the creditworthiness of the business can be more complicated than is the case with residential mortgages.

Some commercial mortgages are nonrecourse; that is, in the event of default in repayment, the creditor can only seize the collateral but has no further claim against the borrower for any remaining deficiency. The general reason for this is twofold: many laws significantly prevent the creditor from going after the borrower for any deficiency, and mortgages structured for sale as bonds give a higher priority to constantly receiving some sort of income and therefore require a clause that allows the lender to take the property immediately, regardless of bankruptcy proceedings that the borrower might be going through.

Frequently, the mortgage is supplemented by a general obligation of the borrower or a personal guarantee from the owner(s), which makes the debt payable in full even if foreclosure on the mortgaged collateral does not satisfy the outstanding balance.

Refinancing refers to the replacement of an existing debt obligation with a debt obligation bearing different terms.

Refinancing may be undertaken to reduce interest costs (by refinancing at a lower rate), to extend the repayment time, to pay off other debts, to reduce one’s periodic payment obligations (sometimes by taking a longer-term loan), to reduce or alter risk (such as by refinancing from a variable-rate to a fixed-rate loan), and/or to raise cash for investment, consumption, or the payment of a dividend.

In essence, refinancing can alter the monthly payments owed on the loan either by changing the loan’s interest rate or by altering the term to maturity of the loan. More favourable lending conditions may reduce overall borrowing costs. Refinancing is used in most cases to improve the overall cash flow. Therefore, your bills and payments are lower than before.

Another use of refinancing is to reduce the risk associated with an existing loan. Interest rates on adjustable-rate loans and mortgages shift up and down based on the movements of the various indices used to calculate them. By refinancing an adjustable-rate mortgage into a fixed-rate one, the risk of interest rates increasing dramatically is removed, thus ensuring a steady interest rate over time. This flexibility comes at a price, as lenders typically charge a risk premium for fixed-rate loans.

Short-term (usually 3 years) real estate financing is secured by a mortgage on the property being financed. This loan is meant to cover the cost of land development and building construction and is disbursed (1) as needed, (2) as each stage is completed, (3) according to a prearranged schedule, or (4) when some condition is met. Construction loans are paid off from the proceeds of permanent financing (usually for 20 to 30 years), which in turn is repaid from the cash flow generated by the completed building and is arranged before the construction loan is disbursed. Also called a building loan, a construction mortgage, or a development loan.

A hard money loan is a specific type of asset-based loan financing in which a borrower receives funds secured by the value of a parcel of real estate. Hard money loans are typically issued at much higher interest rates than conventional commercial or residential property loans and are almost never issued by a commercial bank or other deposit institution. Hard money is similar to a bridge loan, which usually has similar criteria for lending as well as costs to the borrowers. The primary difference is that a bridge loan often refers to a commercial property or investment property that may be in transition and does not yet qualify for traditional financing, whereas hard money often refers to not only an asset-based loan with a high interest rate but possibly a distressed financial situation, such as arrears on the existing mortgage, or where bankruptcy and foreclosure proceedings are occurring.

Many hard-money mortgages are made by private investors, generally in their local areas. Usually, the credit score of the borrower is not important, as the loan is secured by the value of the collateral property. Typically, the maximum loan-to-value ratio is 65-70%. That is, if the property is worth $100,000, the lender would advance $65,000–70,000 against it. This low LTV provides added security for the lender in case the borrower does not pay and they have to foreclose on the property.

The U.S. Small Business Administration 504 Certified Development Company Loan program, or SBA 504 loan program, is available to for-profit, non-publicly traded businesses throughout Florida that meet certain small business criteria. The program is designed to promote business growth and job-creation through fixed-rate financing of major fixed assets. This can include new or existing facilities, or machinery and equipment. ABMC Capital Group, LLC works closely with local small and mid-sized business throughout Florida with all of their small business financing needs.

The United States Small Business Administration created the SBA 504 loan program for economic development purposes. The program is available exclusively through Certified Development Companies (CDC) who support and promote economic growth in their local communities. The SBA authorizes CDCs to work closely with third-party lenders to coordinate the details of the financing between all parties involved.

We can lend, on the first loan, up to $15 million purchase combined loan to value 90%, and up to $5 million on a second loan. A low 10% down payment requirement allows borrowers to conserve their working capital. Multiple loans for certain energy-efficient or manufacturing projects may be approved for up to $5.5 million per loan but the projects will need to be reviewed by the CDC and lender.

SBA 504 Program Qualifications

In order to be eligible for the SBA 504 loan program, you must:

- Be a for-profit, non-publicly traded business.

- Have evidence of business net worth that does not exceed $15 million.

- Have an average net income that does not to exceed $5 million for the two years prior to application.

- Have personal liquidity of each principal not exceed the total project costs of the proposed SBA 504 loans.

- Have business ownership comprised of at least 51% U.S. citizens or Legal Permanent Residents.

Eligible Uses for SBA 504 Loans

The SBA 504 Loan Program supports business growth and job-creation. Investments that support these goals include:

- Purchasing land

- Funding new construction costs

- Acquiring, expanding, or renovating existing buildings

- Securing long-term use equipment and machinery

- Improving and modernizing existing facilities, parking lots, streets, and land.

- construction site funded by SBA 504 Loans.

Funds cannot be used for:

- Funding inventory

- Securing working capital

- Speculation or investment in rental real estate

- Consolidating, repaying, or refinancing debt.

Apply for Your SBA 504 Loan Today

Most SBA 504 loans are fixed-rate loans offered at below-market rates and are fully amortized over the life of the loan (avoiding balloon rates). Terms are usually 10, 15 or 20 years, including financing for machinery or equipment. Additionally, occupancy must usually be 51% of existing buildings (including renovations or expansions) and 60% for new construction projects (which must occupy 80% within ten years).

Contact ABMC Capital Group, LLC for all of your small business financing needs throughout Florida or Get Started With Your SBA 504 Loan Today.

OUR PROPERTY VALUE Wizard:

Accurate and Private Quotes in Just 30 Seconds

Are you curious to know what your property is worth in today’s commercial real estate market? Whether you are planning on selling or refinancing your commercial property, use this FREE self-help tool to get an accurate estimate of your property’s value.

Quick, 30-second form.

No social security number needed.

No credit check required.

Hassle-free, no-obligation process.

OUR PROPERTY VALUE Wizard:

Accurate and Private Quotes in Just 30 Seconds

Are you curious to know what your property is worth in today’s commercial real estate market? Whether you are planning on selling or refinancing your commercial property, use this FREE self-help tool to get an accurate estimate of your property’s value.

We Provide Clients With Top Commercial Mortgage Loans

Our team is committed to providing all clients with the highest quality financial services combined with the lowest rates available in your area. The outstanding mortgage professionals here will work with you one-on-one to ensure that you get a financial solution that is tailored specifically to meet your financing needs. Whether you are purchasing your dream home, refinancing an outstanding loan, or consolidating debt, this highly experienced team of loan officers can help you find the right loan program at the lowest rate, no matter what your needs are.

Button

Button Button

Button

Proudly Building Trusted and Lasting Partnerships

The ultimate goal at ABMC Capital Group, LLC., is to create lasting relationships with each and every client so that providing excellent service will continue for many years to come. Unlike many of the larger nationwide mortgage companies that are out there, all your information will be kept secure and private. The ABMC Capital Group, LLC. name is trusted throughout the community.

Accountant (CPA)

Francisco J. Arguelles, CPA

Address:

201 Cross Street

Miami Springs, FL, 33166

Work Phone: 305-887-5016

Email: fjacpa@bellsouth.net

Attorney

Roland J. Martinez, PA

Address:

1102 Ponce de Leon BLVD.

Coral Gables, FL, 33134

Work Phone: 305-447-6999

Email: roland@rjmpalaw.com

Review Our Checklists of Required Items.

Review Our Checklists of Required Items

1. EXECUTIVE SUMMARY OF THE DEVELOPMENT

2. CONSTRUCTION BUDGET including hard and soft costs.

3. BACKGROUND / BIO ON EACH PARTNER emphasizing development, construction, renovation, real estate experience and past projects that have been completed successfully.

4. BACKGROUND / BIO / RECENT SIMILAR PROJECTS COMPLETED for each architect, contractor and construction manager (if applicable).

5. A personal financial statement for each partner with an interest rate of 10% or more.

6. LAST TWO YEARS’ 1040 TAX RETURNS for each partner with an interest of 10% or more in the project.

7. PROPOSED SALE PRICES AND MARKETING PLANS for completed units (only if condominiums).

8. COMPARABLE SALES INFORMATION for both residential apartments and any commercial space (only if condominiums).

9. RENTAL ANALYSIS OF THE PROPERTY (based on the estimated rental value of the completed units, including any commercial space).

10. COPY OF FULLY EXECUTED PURCHASE CONTRACT

11. COPY OF APPROVED BUILDING PLANS

12. COPY OF ZONING ANALYSIS

13. COPY OF DEED

14. EVIDENCE THAT THE PARTNERS CONTROL ANY DEVELOPMENT RIGHTS NECESSARY TO EXECUTE THE PLANS

15. TIMELINE showing key points from the beginning to the completion of the project.

16. COPY OF THE CONTRACT between the developer and the general contractor.

17. LLC AGREEMENT OR ARTICLES OF INCORPORATING OF ENTITY, IF ANY

1. INCOME/EXPENSE STATEMENT for the last 3 years with monthly and annual figures.

2. SUMMARY OF ALL COMMERCIAL OR DEPARTMENTAL LEASES (if any) showing escalations and expirations, and the summary of the terms of any franchise agreements.

3. COMPLETE, DETAILED PHYSICAL DESCRIPTION, INCLUDING SQUARE FOOTAGE.

4. IF ACQUISITION, PROVIDE A COPY OF THE FULL EXECUTED CONTRACT OF SALE.

5. IF REFINANCE, PROVIDE THE ORIGINALLY PAID PRICE FOR THE PROPERTY, the date originally purchased, and a summary of current financing.

6. PHOTOS (at least 5)

7. PROPERTY SURVEY OR SITE PLAN

8. SUMMARY OF CURRENT FINANCING (for refinance only), including:

- Current Lender

- Current principal balance

- Current interest rate

- Current monthly payment

- Maturity date

- Prepayment penalty information

9. CURRENT PERSONAL FINANCIAL STATEMENT

10. LAST THREE YEARS’ BUSINESS TAX RETURNS

11. BACKGROUND /BIOS FOR EACH PARTNER AND FOR THE OWNERSHIP ENTITY, EMPHASIZING HOTEL / HOSPITALITY INDUSTRY / REAL ESTATE EXPERIENCE

12. BACKGROUND INFORMATION ON MANAGEMENT COMPANY, only if separate from ownership.

13. RENOVATION HISTORY FOR AT LEAST 3 YEARS with project descriptions and the approximate amount paid for each.

CURRENT BUSINESS FINANCIAL STATEMENT

LAST TWO YEARS PERSONAL TAX RETURNS

1. CURRENT RENT ROLL, including:

- Regulated units ( controlled, stabilized)

- Apartment number

- Room / Bathroom count

2. COMPLETE INCOME/EEXPENSE STATEMENT on the property, including:

- Annual property taxes

- Insurance

- Water / Sewer

- Fuel, Electricity

- Maintenance repairs, and management

3. SUMMARY OF ALL COMMERCIAL LEASES (if any) that show expirations and escalations

4. COMPLETE, DETAILED PHYSICAL DESCRIPTION, INCLUDING SQUARE FOOTAGE.

5. IF ACQUISITION, PLEASE PROVIDE A COPY OF THE FULLY EXECUTED CONTRACT OF SALE.

6. IF REFINANCE, PROVIDE THE ORIGINALLY PAID PRICE FOR PROPERTY, date of purchase, and summary of current financing.

7. PHOTOS (at least 5)

8. SITE PLAN OR PROPERTY SURVEY, if available.

9. SUMARRY OF CURRENT FINANCING (refinance only), including:

- Current Lender

- Current principal balance

- Current interest rate

- Current monthly payment

- Maturity date

- Prepayment penalty information

10. CURRENT BUSINESS FINANCIAL STATEMENT

11. CURRENT PERSONAL FINANCIAL STATEMENT

12. LAST 2 YEARS PERSONAL AND BUSINESS TAX RETURNS

1. CURRENT BALANCE SHEET

2. LAST 3 YEARS PROFIT AND LOSS (P&L) STATEMENT AND YEAR TO DATE P&L

3. COMPLETE INCOME / EXPENSE STATEMENT on the property including:

- Annual property taxes

- Insurance

- Water / Sewer

- Fuel

- Electricity

- Maintenance and Repairs

- Management

4. SUMMARY OF ALL LEASES (if any) showing escalations and expirations

5. COMPLETE, DETAILED PHYSICAL DESCRIPTION, INCLUDING SQUARE FOOTAGE

6. IF REFINANCE, ORIGINAL PRICE PAID FOR PROPERTY, date of purchase and summary or current financing.

7. IF ACQUISITION, COPY OF FULLY EXECUTED CONTRACT OF SALE

8. PHOTOS (at least 5)

9. SITE PLAN, or property survey.

10. SUMMARY OF CURRENT FINANCING (refinance only), including:

- Current Lender

- Current principle balance

- Current interest rate

- Current monthly payment

- Maturity date

- Prepayment penalty information

11. FULL DESCRIPTION AND/OR HISTORY OF BUSINESS

12. RESUME OF PRINCIPAL / BIO

13. LAST 3 YEARS OF PERSONAL AND BUSINESS TAX RETURNS FOR OPERATING COMPANY AND AFFILIATES

14. COPY OF DEED

1. CURRENT RENT ROLL, including:

- SF of units

- Lease abstract details, such as

- Escalations, commencement and expirations, add-ons, description of tenant, Description of any added rent that the tenant is responsible for (In addition, three-year historical data would be ideal)

2. COMPLETE INCOME/EEXPENSE STATEMENT on the property, including:

- Annual property taxes

- Insurance

- Water / Sewer

- Fuel Electricity

- Maintenance / Repairs

- Management

- Leasing commissions, tenant improvements

3. A COMPLETE DETAILED PHYSICAL DESCRIPTION along with the SITE PLAN or Property Survey.

4. IF REFINANCE, PRICE THAT WAS ORIGINALLY PAID FOR THE PROPERTY, date of said purchase, and summary of current financing.

5. IF ACQUISITION, PROVIDE A COPY OF THE FULLY EXECUTED CONTRACT OF SALE.

6. PHOTOS (at least 5)

7. SUMMARY OF CURRENT FINANCING (refinance only), including:

- Current Lender

- Current principle balance

- Current interest rate

- Current monthly payment

- Maturity date

- Prepayment penalty information

8. INFORMATION ON MANAGEMENT COMPANY, if separate from ownership.

9. CURRENT BUSINESS FINANCIAL STATEMENTS

10. CURRENT PERSONAL FINANCIAL STATEMENTS

11. LAST TWO YEARS PERSONAL TAX RETURNS

12. LAST TWO YEARS of TAX tax returns

Start Your Property Search Today

ABMC Capital Group, LLC has established relationships with commercial real estate agents across the country. Use this free self-help tool to instantly access one of the largest databases of commercial properties for sale in the nation.

Frequently Asked Questions

See some common inquiries and their answers below.

-

Why is ABMC Capital Group so popular?

At ABMC Capital Group, our popularity stems from our unmatched expertise in commercial mortgage loans. We specialize in delivering commercial mortgage loans tailored to each client's unique needs, setting us apart in the industry. Our focus on commercial mortgage loans allows us to offer competitive rates and flexible terms that resonate well with our clients. We take pride in our ability to navigate the complexities of commercial mortgage loans, ensuring a smooth and efficient process for all parties involved. Moreover, our commitment to providing personalized service in the commercial mortgage loan sector fosters long-term relationships and solidifies our reputation as the go-to experts for financial needs.

-

Why use a commercial mortgage broker?

A top-quality mortgage broker can help you navigate through the ever-changing mortgage market and identify and target the best opportunities. This can easily save you much more than the broker’s fee. As a result of being “in the trenches” every single day of every single week, a good broker is at the cutting edge of what is being offered, of how far the envelope can be pushed, as well as the specific language beneficial to the borrower that has been successfully negotiated on other transactions, etc.

The key to choosing a broker is the same as for choosing any other professional. Word-of-mouth references, as well as due-diligence on the broker’s background, experience and reputation, are important. Of course, it’s critical that the broker you choose is deeply engaged in the current mortgage marketplace, is a good communicator and is a skilled negotiator.

Utilizing a good mortgage broker allows you to tap in to a high level of expertise and experience that can help you best achieve your goals.

-

How long will the process take?

Assuming that the Borrower has made a decision to proceed and has delivered all the key documents needed to underwrite the loan to the broker, 60–120 days would be the typical range. Going from “first phone call” to a closing in 60 days requires smooth choreography among all the parties.

All key players, from the borrower, the mortgage broker, the borrower’s attorney, and the title company, to the bankers, the bank’s attorneys, the appraiser, engineer and environmental consultant, need to be kept in forward motion because if any player drops the ball, the whole schedule can and will go awry. The most typical time frame to close a commercial mortgage is somewhere between 90 and 120 days.

Occasionally, an investment opportunity may present itself to an investor and must be acted upon very quickly. Our affiliated company, W Financial, is a direct private lender capable of closing on a transaction in as little as one week. Learn more about W Financial by visiting: www.w-financial.com

-

When can I lock my rate?

This varies from lender to lender. In some cases, the answer is immediate (meaning within a day or two of initial submission), and in others, it may take three or four weeks from a borrower’s acceptance of a formal application until the lender delivers a commitment letter, at which time the borrower may elect to lock the rate.

-

How do lenders underwrite rental properties?

It’s not an uncommon dream: Sell the co-op or condo apartment and buy a townhouse or a loft building. Live in it, collect rent and best of all, escape the sometime tyranny of co-op or condo life. If, however, the building being purchased has more than 5 apartments (and/or contains commercial space making it a “mixed-use” property), the cookie-cutter financing provided to buyers of 1 – 4 family homes disappears from the radar screen. If the buyers seek financing, they will be looking for a commercial, not a residential mortgage.

Many buyers assume that they can obtain financing for around 75% of the purchase price. The fact is that they can usually borrow about 75% of the property’s appraised value. Depending on a variety of factors, ranging from long-deferred maintenance to low rents being paid by rent-regulated tenants, there may be quite a disparity between the property’s purchase price and its appraised value. This can result in quite a surprise for a buyer who may need to provide considerably more equity than was initially expected. Today’s low interest rates are certainly helpful, but they will not necessarily result in higher loan amounts due to such valuation constraints.

It is common for a “gap” to exist between the premium price that a Manhattan brownstone or townhouse commands in the marketplace and its appraised value as seen “through a lender’s eyes”. Part of the explanation for the “gap” pertains to elements of ownership that will benefit an owner/occupant, but would be meaningless to an investor. While the lender will size up a property much like a serious real estate investor, concentrating on the property’s cash flow, an owner-occupant enjoys benefits such as living in the property as well as tax benefits which may justify paying a premium price.

A typical recent example involves an eight-unit, Upper West Side townhouse in contract for $4,450,000. 75% of the purchase price would be $3,337,500. However based on the actual income and expenses of the building a lender would barely be able to justify a $3,769,494 value (see chart on page 2). Even if the lender is willing to consider a blend of the sales price of the property and it’s value to an investor, the appraised value may still not exceed $4,059,747. 75% of $4,059,747 is only $3,044,810, which is $292,690 less than the mortgage amount the buyer was hoping for. Yet based on the above income and expense assumptions, ~$3,250,000 is a loan amount that would likely be comfortable for a number of lenders.

Vacancies in a prospective property present less of a problem as lenders are usually willing to attribute “market rents” to those units. Lenders generally assume that the building’s new owner will be able to fill the vacant units within a reasonable amount of time. Of course, the lender will also check public records (DHCR filings, etc.) to ensure that any vacant units are free of rent restrictions. The buyer cannot automatically presume that a vacant unit can be rented at “market value.” Over time, rents may be increased via vacancy and renovations above $2,000 and therefore become deregulated. If a unit that will be owner-occupied could be rented for, say $10,000 per month, lenders will typically include such market rents in their income calculations.

“Projected” rent rolls often make sweeping assumptions about what might happen in the future if all goes perfectly according to plan. A buyer may see huge upside potential in a given property, assuming that deals can eventually be struck with low rent-paying tenants, but a lender will be acutely aware of the risk that any rent-regulated tenant(s) may not leave.

Let’s take a very basic look at how a lender typically analyzes the cash flows in a multifamily rental property. For the sake of simplicity, let’s assume for this example that there are no stores or other commercial spaces:

Purchase Price: $4,450,000 | Proposed mortgage amount: $3,200,000 (73% of purchase price, 75% of value)

Start with the gross annual income: [$470,088]

- Now subtract a 5% vacancy allowance from that number: [-$23,504 = $446,584]

- Now take that result and subtract a 5% management allowance: [-$22,329 = $424,255]

- Next subtract the actual current expenses (We’ll assume $85,000 for this example). Remember to include all other typical categories such as: RE taxes, water and sewer taxes, fuel, utilities, payroll, repairs and maintenance, legal & accounting, replacement reserves, and miscellaneous (each lender will have their own way of estimating these expenses based on their past experiences). For small buildings with 10 or fewer units, some lenders will plug in $300 or $400 per unit for management expenses rather than 5% of the income).

- The resulting number is your net operating income (NOI). [$339,254]

- Now plug in the annual interest and principal payments for your proposed mortgage amount with a realistic “ballpark” estimate for the interest rate and amortization schedule. As of 6/18/03, let’s assume a 4.75% rate amortizing on a 25-year schedule: [$226,478]

- You should now be able to multiply your annual debt service by 1.25 and get a number equal to, or less than, the net income [$339,254]. If the property you are seeking to buy passes this test, then there are probably a number of lenders who will be interested in financing it for you. If your prospective purchase does not pass the test, reduce the loan amount until it does. This will give you a very realistic way to “screen” properties to see what you can comfortably afford to buy.

- This example yields a debt service coverage ratio (DSCR) of 1.53, which is comfortably better than the minimum 1.25 coverage that most lenders would seek (Net Operating Income [NOI] = $339,254, divided by (annual debt service $222,346) = 1.53. Although the required DSCR varies according to property type and from lender to lender, it is a simple enough concept. It is essentially a “cushion” that assures the lender that even if some income is lost during the course of the loan term for some reason, the borrower will still have sufficient income to service the mortgage on the property.

Even when a building passes the DSCR test comfortably (as in this example), there are other parameters that lenders and appraisers use that may limit the loan amount, such as what capitalization rate is deemed appropriate, and whether the lender gives more weight to the income approach or to the sales approach.

There are plenty of variations on the theme of how different lenders evaluate, define valuations and establish loan amounts based on many details that are not readily apparent to the borrower. However, a conceptual understanding of how lenders approach underwriting a multifamily loan will be helpful if and when you or your client are exploring this market.

-

How can I minimize my prepayment penalty?

Methods to minimize the impact of prepayment penalties:

Currently, many borrowers are faced with a dilemma: Should they refinance now and pay a significant penalty, or should they wait until the penalty disappears, hope that rates are still attractive and refinance at that point in time? There is a very interesting solution to solve this dilemma. I am pleased to report that we are handling several transactions where we are locking in an interest rate now for a borrower where the closing will not occur until much later. In some cases, the closing can occur 10, 11 or even 12 months from the day that we initiate the process. This can allow a borrower to achieve the best of both worlds:

- to lock in lowest possible interest rate now, and

- to minimize the prepayment penalty on their current loan.

Any borrower with either a fixed or a yield maintenance prepayment penalty with 12 to 24 months remaining until maturity can benefit from this forward commitment and early rate lock program. Please give us a call if you would like to discuss in greater detail whether this program would be beneficial to you or your client.

-

What is a yield-maintenance prepayment penalty and how is it calculated?

Yield maintenance is a prepayment penalty that, in the event the borrower pays off a loan before maturity, allows the lender to attain the same yield as if the borrower had made all scheduled mortgage payments until maturity. Yield maintenance premiums are designed to make lenders indifferent to an early prepayment by a borrower. On the flip side, it can mean that if a borrower currently has a 9.5% rate on its mortgage with 5 or 6 years to go until maturity, at this time the penalty could well be huge.

For example, let’s assume a 15-year interest-only $1,000,000 mortgage at 7%. After the fifth year, the borrower decides to refinance. The yield maintenance prepayment penalty would equal the difference between the current 7% rate and the yield that the bank would receive reinvesting the loan proceeds in a 10-year Treasury Note. (10 years being the remaining term of the loan).

To keep this example simple, let’s say that at the time of prepayment, the 10-year Treasury note is at 5%. The borrower would be required to pay the lender the present value of the 2% difference for each year over the loan’s ten remaining years, or $200,000. This penalty will make the lender “whole” and insure that the lender will not experience an economic loss as a result of being paid prior to the loan’s maturity. This same formula applies to amortizing loans; however, it is much easier to illustrate with an interest-only loan.

Each lender will have a slight variation to this formula; however, the above example conveys the spirit of the yield maintenance penalty.

-

What are the biggest mistakes that borrowers commonly make?

Sometimes a new client will ask what issues tend to come up again and again during the commercial mortgage financing process and what mistakes they should try to avoid. Here are the top seven mistakes that come to mind. As you’ll see, most of these fall under the general topic of “timing is everything”:

1) Searching too hard for the “bottom” when choosing the moment to lock an interest rate-Focus on the monthly/annual payment being within your target range. DO NOT focus on hitting the absolute bottom.

2) Working with multiple brokers:

The myth is that taking this approach benefits the borrower because it generates more market coverage and insures a better result. In the borrower’s mind, the math goes something like this: “more brokers means more offers, which should result in a better deal for me”.

The fact is that when lenders start seeing the same loan submission coming in from multiple sources, they assume that no one is actually in control of the deal. Lenders are less likely to put their best efforts forward in such a fuzzy environment.

The borrower’s best strategy is to do some meaningful due diligence, check references and select a knowledgeable, well-staffed and reputable broker. Exclusively engage that broker for a finite period of time, and allow that broker to work the entire marketplace to obtain the best pricing and structure.

3) Failing to recognize and effectively negotiate significant deal points in the lender’s offer letter right at the beginning.

For commercial mortgages, a lender’s initial offer letter or term sheet is typically short on fine detail. Nevertheless, you should bring up any significant points that are important to you at this early stage. Various important deal terms may be much more difficult to modify later on, once the loan has been approved and the commitment letter has been issued. The offer letter stage is the time to address tax escrows, the lender’s calculation method (30/360 or Actual/360), issues of timing (rate lock, closing schedule), and any other points that may be of importance to you BEFORE you’ve posted a good-faith deposit.

4) Assuming (especially in NY state) that the mortgage can be assigned, but waiting too long to see whether: a) the old lender will cooperate, b) all the necessary original documents are available, and c) your attorney prepares a draft assignment in a timely manner.

5) Not considering all of the currently available loan products for your situation

Lots of owners know one or two lenders and fall into the habit of calling the same one or two lenders with whom they are comfortable when it’s time to refinance an old property or to finance the acquisition of a new one. This is a good habit to overcome. The financing marketplace is ever-changing. To get the best result, you need to scan (or have a good broker scan) the overall landscape in order to determine your best move. There may be players and products that an owner/borrower is unaware of that may turn out to be the most logical fit and the smartest business move.

For example: Perhaps you own 10 apartment buildings and have always tended to choose typical “5 and 5” type loans. This time, take a fresh look. The marketplace is fluid, as are the interest rates. With the 10-year Treasury currently (as of June 16, 2003) at 3.17%, a 10-year fixed-rate deal at 4.25% might be worth a close look. With 30-year fixed rates available below 5%, a long-term, fully amortizing loan might well be worth considering. If you’re planning a sale in the near term, a LIBOR-floater might be a good idea, as it will have an amazingly low rate (perhaps below 4%) and no prepayment penalty.

6) Using the wrong lawyer

Sometimes a borrower feels compelled to use a lawyer who is a friend or perhaps his brother-in-law (who happens to be a matrimonial or estate attorney) to close a commercial Real Estate transaction. My advice is simply: Don’t! Most borrowers will end up saving money and perhaps shaping the terms of the deal far more to their liking if they hire a seasoned pro. Using a lawyer who is inexperienced in this very specialized area will only run up the bank attorney’s bill and may well cause the borrower to need to extend the time to close, which may result in additional fees and penalties, etc. The best advice to achieve a smooth closing is to choose a real estate lawyer who is a seasoned pro in this very specialized (commercial vs. residential) field.

7) Failing to give adequate notice

One possible consequence of making the wrong choice for #6 or the wrong choice of broker might be failing to give adequate notice to the CURRENT lender that their loan is soon to be paid off. Make sure to check and act upon the notice requirement on the outgoing loan BEFORE locking the rate on a new mortgage.

Half the battle is simply taking the appropriate action at the right time. Good timing can help you win almost every deal point the next time you negotiate a commercial mortgage.

-

How can you make your commercial mortgage closing go more smoothly?

We’re all aware of the “time value of money.”. Well, we should also compare the strategic value of a simple action taken at the right time with the value of the same action taken too late in the game. The difference can (and usually does) amount to an easy task that has now been transformed into a pressure-cooker, error-prone, last-minute nightmare. Whenever possible, use the fallow time (between accepting a lender’s offer and receiving the commitment) to your best advantage, clearing as many obstacles out of the way as possible.

Anticipate the obvious:

While no one can ever anticipate every possible contingency or problem that might arise during the financing process, it’s fairly simple to anticipate a number of routine occurrences and requirements and to sweep as many of them out of the way as early in the process as possible. Clearly, once you have accepted an offer from a lender and you’re waiting for the commitment to be issued, it’s usually a good idea to pull the trigger and order the title searches. Most real estate attorneys can order title work from a company that they regularly use and are willing to assume the risk that if the deal does not close, there will be no fees for the searches.

Since title work is still one of the more primitive and time-consuming parts of the process, the earlier you start, the better. That way, there will be plenty of time to deal with delays and to resolve pesky violations or other issues that may arise before the stress-laden pre-closing days arrive.

With regard to the survey, at the very least, make sure you’re aware of the new lender’s requirements. For example, if your new lender will require an ALTA survey, and the old survey was not prepared to those specifications, order it once you’ve accepted an offer rather than waiting for the commitment as the survey could easily take 4 – 6 weeks. Many surveyors are currently quite busy and not famous for quick turnaround, so by all means don’t leave this until the end.

Assignment of old mortgage – 1) God-given right, or 2) professional courtesy typically extended?:

” What do you mean, I’ll have to pay $154,000 in mortgage tax?!!!!”

No one wants to pay any more mortgage recording tax than absolutely necessary. Remember that if the property is in New York City, the borrower will have to pay mortgage recording tax for loans above $500,000 of $27,500 per million. Clearly you will want to minimize this tax by having your new lender take an assignment of the old mortgage. Let your new lender’s attorneys review, comment upon and approve the old mortgage and note early, rather than late, in the process. This is one more simple step that you and your attorney can take to minimize stress in the days leading up to your closing.

Don’t paint yourself into a corner:

With regard to the structure of the loan, at the outset, consider all the different ways your project may play out and plan appropriately. For example, if there is a chance that you will convert your newly acquired multifamily or mixed-use property to condominiums sometime down the road, you will want to be 100% sure that your lender will agree to having their loan repaid as units are sold (and as their collateral is whittled away). A long-term fixed rate might be a terrific play given today’s interest rates, but not if you might convert your new project to condominiums and may therefore need to prepay your mortgage incrementally.

Similarly, if there’s a good chance that you might sell the property within a few years of your closing, plan carefully about your prepayment penalty and/or your new lender’s willingness to permit a buyer to assume the mortgage.

To sum up: There are enough things that can go wrong and/or cause delays. In order to achieve a smooth closing, use any slack time to move as many of the obvious tasks from the “to do” column to the “completed” column sooner, rather than later. When crunch time comes just before the closing, you’ll want to be concentrating on any important loose ends in the mortgage documents, rather than being distracted by the trivia and “white noise” of routine tasks that should have been completed weeks earlier.

Get Free Expert Advice - Ask a Private Lender

Use this form to receive FREE advice from one of our experienced professionals regarding any commercial mortgage and/or commercial real estate-related topics.